Iran Reportedly Slows Nuclear Enrichment, As It Exports More Oil

Iran is slowing the pace at which it is accumulating uranium enriched at 60 percent, the International Atomic Energy Agency (IAEA) is expected to report in September.

Iran is slowing the pace at which it is accumulating uranium enriched at 60 percent, the International Atomic Energy Agency (IAEA) is expected to report in September.

Bloomberg reported Thursday that IAEA inspectors are preparing to submit their quarterly report on Iran to members of the agency’s board ahead of their mid-September meeting.

There have been media reports in the past few months that the United States is indirectly negotiating with Iran over a step-by-step approach to relax sanctions in return for a slowdown in Tehran’s nuclear program.

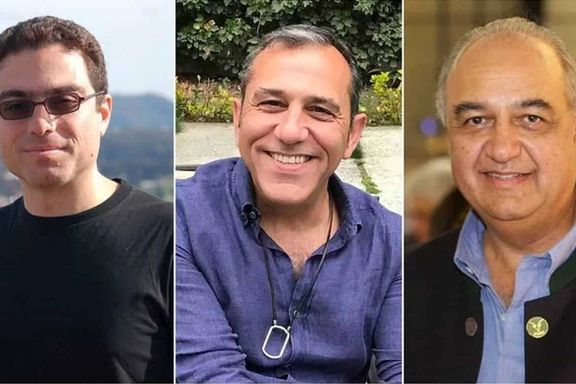

Earlier in August Washington approved the release of $6 billion of Iran’s oil money frozen in South Korea due to US sanctions, in exchange for the eventual release of five US citizens held hostage by the Islamic Republic. This followed a move by the Biden administration in June to allow Iraq to release $2.7 billion it owed Iran for imports of gas and electricity.

The funds will be transferred to Qatar and Oman from where Tehran can use the money for imports of food, medicine and other non-sanctionable goods, according to the United States.

If the IAEA reports a slowdown in Iran’s uranium enrichment, it would strengthen speculations of a non-written and informal deal between Tehran and Washington. While the Biden administration wants to reduce tensions in the region before the US presidential elections next year, it does not want a formal nuclear agreement with Tehran perhaps to avoid Congressional oversight. According to a 2015 law, Congress must have a say in any new nuclear deal.

Already, Iranian oil exports have increased, despite US sanctions, to almost pre-sanctions levels, with the highest shipments reported for August. Iran exported an average of 1.85 million barrels per day, an almost 30 percent jump from previous months.

A Reuters survey published on Thursday showed OPEC’s oil output rose in August as Iranian supply jumped to its highest since 2018, despite ongoing cuts by Saudi Arabia and other members of the wider OPEC+ alliance to support the market.

Iran is exempt from OPEC cuts and its exports have been rising in 2023 despite US sanctions, although views differ as to the exact scale. The overall development, some analysts say, is adding to OPEC+'s challenge in managing the market.

"Iran's output and export data are not transparent and major decision-makers like OPEC+ that adjust their production to balance the market can't be assured of Iran's supplies in the months to come," Sara Vakhshouri of consultant SVB International was quoted by Reuters as saying.

Iran’s oil shipments declined to around 200,000 barrels per day from a high of more than 2 million barrels after the United States withdrew from the JCPOA nuclear deal in 2018 and imposed sanctions. However, Tehran began increasing its exports toward the end of 2020 when President Joe Biden signaled his decision to try to return to the JCPOA. China, Iran’s main customer, apparently seeing signs of a softer approach by the US began increasing its purchases.

Nearly 18 months of talks to revive the JCPOA failed in September 2022, but shortly after secret talks apparently resumed.

The current jump in exports appears to be related to these secret talks between Tehran and Washington. Reuters quoted analysts as saying the higher exports appear to be the result of Iran's success in evading US sanctions and Washington's discretion in enforcing them as the two countries seek better relations.

So far, there is no visible positive signs of higher oil revenues on Iran’s beleaguered economy, because US banking sanctions apparently limit Iran’s hard currency gains from the sales. If the Biden administration also relaxes the banking sanctions, Iran’s annual oil revenues could easily surpass $40 billion.