Iran's electricity deficit halves steel production

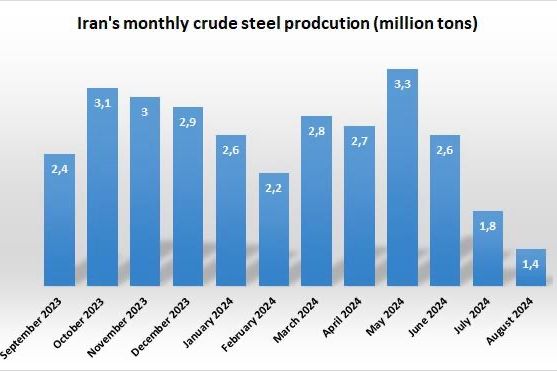

Iran's crude steel production last month declined to 1.4 million tons, which is less than half of the country's monthly nominal steel production capacity.

Iran's crude steel production last month declined to 1.4 million tons, which is less than half of the country's monthly nominal steel production capacity.

This summer, Iran faced a 25% power deficit, severely limiting electricity supply to industries, including steel mills, which are heavily dependent on electrical power.

The sharp decline in steel production during the hot season is due to power shortages, a situation mirrored in winter months when gas shortages also lead to significant drops in production.

Iran's power and gas deficits have been worsening dramatically each year. Last summer, the country's electricity shortage reached 11,000 megawatts, rising to 20,000 megawatts this year. Additionally, Iran faced a gas deficit of 250 million cubic meters per day last winter, amounting to 25% of its winter demand.

The trend in declining production is undeniable. Data from the World Steel Association reveals that Iran's steel production in August dropped by 9.9% compared to the same month last year, 33% compared to August 2022, and a sharp 44% compared to August 2021.

Due to reduced operations and under-capacity production this summer, Iran’s crude steel factories have incurred an estimated opportunity cost of $1.5 billion, based on average global steel prices.

The sharp decline in crude steel production has also taken a toll on steel-dependent industries, particularly automotive manufacturing, which saw a 15% drop in production this summer. With a monthly capacity of 120,000 vehicles, the economic loss from this significant downturn in the automotive and parts sectors is substantial.

Additionally, a sharp drop in cement production this summer, also caused by power shortages, has doubled cement prices and halted construction projects across the country.

So far, economic and industrial authorities in the Islamic Republic have not released a report detailing the overall losses incurred by the country’s industries due to the significant electricity and gas shortages. However, some internal estimates, reflected in Iranian media, suggest that last year’s energy shortages cost the country about $8 billion.

Several organizations in Iran's power industry warned earlier this month of a 26,000 MW electricity deficit next summer, exceeding 30% of peak demand, compounded by natural gas shortages affecting both industries and households.

Ali Nikbakht, Chairman of the Iran Power Plants Association, has highlighted the aging and deterioration of a large portion of the country’s power plant infrastructure. He revealed in September that a major power plant has already ceased operations for repairs, noting, “The necessary spare parts should have been ordered two years ago, but they weren't, further worsening the electricity shortage.”

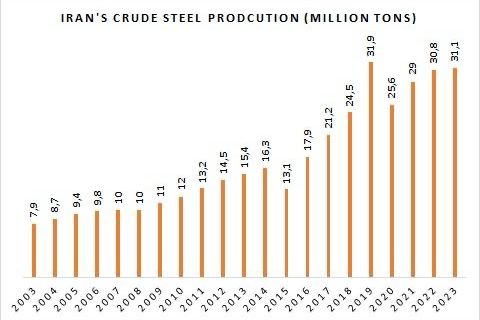

The steel industry plays a crucial role in Iran’s economy, contributing approximately $8 billion and representing 16% of the country’s total non-oil exports. As one of Iran’s most vital industrial sectors, it has been a rare success story over the past two decades, expanding from an annual production of 8 million tons to over 31 million tons.

Data from the World Steel Association indicates that Iran produced 19.8 million tons of crude steel in the first eight months of the current year, a significant portion of which was produced in spring—a season with fewer power and gas shortages.

Iran’s steel production grew rapidly from 2015 to 2019, a result of the nuclear agreement known as the JCPOA (Joint Comprehensive Plan of Action) with world powers, and the widespread inauguration of new steel plants across the country. However, in 2019, following the imposition of US sanctions on Iran's steel exports, the industry experienced a sharp decline.

Over 60% of Iran's steel exports go to Iraq and the UAE. Since 2021, Iran has managed to find ways to circumvent US sanctions on its metals industry, leading to a recovery in production and exports. However, the country's steel output has not yet returned to its 2019 peak levels.